Exploring the value of comparing home and auto insurance bundles, this introduction sets the stage for a detailed analysis of the benefits and considerations involved in bundling these policies.

Providing insights into cost savings, coverage options, and customer experiences, this overview aims to inform readers about the potential advantages of bundling insurance policies.

Introduction

Home and auto insurance bundles refer to the practice of purchasing both home insurance and auto insurance from the same provider as a combined package. This allows policyholders to streamline their insurance needs by bundling multiple policies together.

When it comes to bundling insurance policies, the concept is simple - by combining home and auto insurance, policyholders can often enjoy cost savings, convenience, and potential discounts from insurance companies. This approach is designed to simplify the insurance process for consumers and offer them added value for their coverage needs.

Benefits of Bundling Home and Auto Insurance

- Cost Savings: By bundling home and auto insurance, policyholders can potentially save money on their premiums. Insurance companies often offer discounts for customers who purchase multiple policies from them.

- Convenience: Having both home and auto insurance with the same provider can make it easier to manage policies, payments, and claims. It eliminates the need to deal with multiple insurance companies.

- Bundling Discounts: Some insurance providers offer additional discounts or special offers specifically for customers who choose to bundle their home and auto insurance policies. These discounts can help policyholders save even more on their insurance costs.

- Simplified Coverage: Bundling insurance policies can also help streamline coverage options and ensure that policyholders have comprehensive protection for both their home and vehicles.

Cost Comparison

When it comes to bundling home and auto insurance, one of the biggest advantages is the potential cost savings. By combining both policies with the same insurance provider, you may be eligible for a discount on your overall premium. This can result in significant savings compared to purchasing separate policies from different companies.

Cost Savings Examples

- For example, a study found that policyholders who bundled their home and auto insurance saved an average of 20% on their premiums compared to those who purchased separate policies.

- Another study showed that bundling insurance policies could lead to savings of up to $500 per year, depending on the insurance provider and the specific coverage options chosen.

Factors Influencing Cost

- Insurance companies consider various factors when determining the cost of bundled policies, including your location, age, driving record, credit score, and the value of your home.

- The type and amount of coverage you select for both your home and auto insurance policies will also impact the overall cost of the bundle.

Total Cost Comparison

- When comparing the total cost of separate home and auto insurance policies versus a bundled policy, it is essential to request quotes from multiple insurance providers to identify the most cost-effective option.

- Keep in mind that while bundling may offer significant savings, it is crucial to review the coverage details and ensure that you are adequately protected in case of any unforeseen events.

Coverage Analysis

When comparing home and auto insurance bundles, it's crucial to understand the coverage options included in each policy. This analysis will delve into the typical coverage options for both home and auto insurance, as well as how bundling can impact coverage limits and deductibles.

Home Insurance Coverage Options

Home insurance typically includes the following coverage options:

- Dwelling coverage: Protects the structure of your home in case of damage from covered perils such as fire, windstorm, or vandalism.

- Personal property coverage: Covers your belongings inside the home, including furniture, electronics, and clothing, in case of theft or damage.

- Liability coverage: Provides protection in case someone is injured on your property and decides to sue you for damages.

- Additional living expenses: Covers costs if you need to temporarily live elsewhere while your home is being repaired due to a covered loss.

Auto Insurance Coverage Options

Auto insurance typically includes the following coverage options:

- Bodily injury liability: Covers medical expenses for injuries caused to others in an accident where you are at fault.

- Property damage liability: Covers damage caused to someone else's property in an accident where you are at fault.

- Collision coverage: Pays for repairs to your vehicle in case of a collision with another vehicle or object.

- Comprehensive coverage: Covers damage to your vehicle from non-collision incidents like theft, vandalism, or natural disasters.

Impact of Bundling on Coverage Limits and Deductibles

When bundling home and auto insurance, insurance companies often provide discounts and incentives. While this can lead to cost savings, it's essential to understand how bundling affects coverage limits and deductibles. In some cases, bundling may allow for higher coverage limits or lower deductibles across both policies, providing more comprehensive protection for your assets at a lower overall cost.

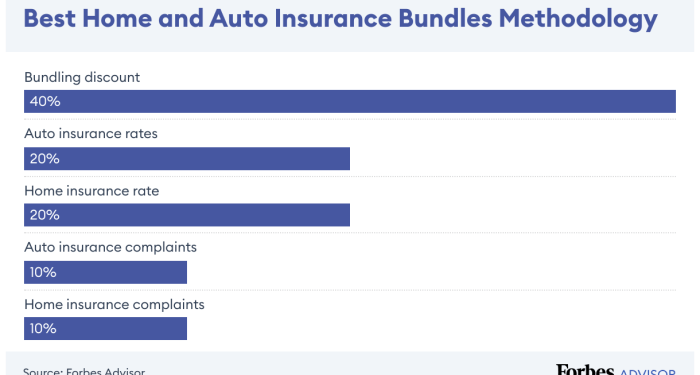

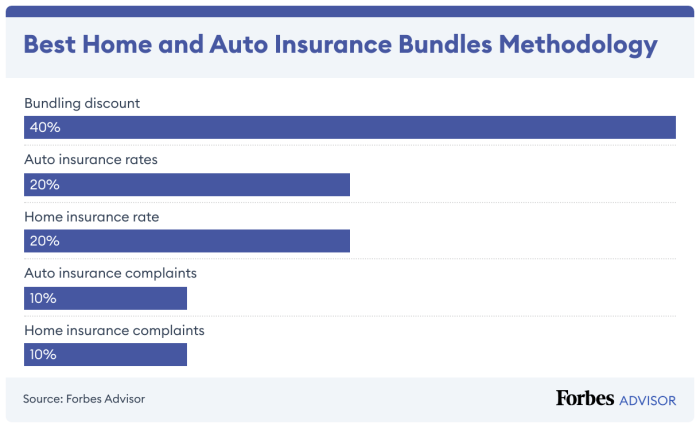

Discounts and Incentives

When it comes to bundled home and auto insurance policies, insurance companies often offer various discounts and incentives to encourage customers to consolidate their coverage. These discounts can help policyholders save money while enjoying the convenience of managing multiple policies under one provider.

Common Discounts Offered for Bundled Policies

- Multi-Policy Discount: This is the most common discount offered when bundling home and auto insurance. Policyholders can save a significant amount by combining both policies with the same insurer.

- Loyalty Discount: Some insurance companies reward long-term customers with additional discounts when they bundle their policies, incentivizing customer retention.

- Claims-Free Discount: Policyholders who have a history of filing few to no claims may qualify for a discount on their bundled policies.

How Loyalty Incentives May Apply to Bundled Insurance Policies

Insurance companies value customer loyalty, and as such, they may offer special incentives to customers who choose to bundle their home and auto insurance with the same provider. These incentives can come in the form of additional discounts, lower deductibles, or enhanced coverage options for long-term policyholders.

Comparison of Discounts Available for Individual Policies vs. Bundled Policies

- Individual Policies: While some discounts, such as multi-policy discounts, may still apply to individual home or auto insurance policies, the savings are typically higher when policies are bundled together.

- Bundled Policies: Bundling home and auto insurance policies can lead to more significant discounts and cost savings compared to purchasing separate policies. This is because insurance companies often offer exclusive discounts and incentives for bundled policies to attract and retain customers.

Customer Experience

When it comes to bundled insurance policies, customer experience plays a crucial role in determining the overall satisfaction and convenience for policyholders. Let's delve into some key aspects related to customer experience with bundled home and auto insurance.

Customer Testimonials and Reviews

- Many customers have shared positive testimonials highlighting the ease of managing a single bundled policy for both home and auto insurance.

- Reviews often mention the cost-effectiveness and convenience of having all insurance needs covered under one policy.

- Some policyholders appreciate the streamlined communication and customer service experience that comes with a bundled insurance policy.

Convenience of Managing a Single Bundled Policy

- Managing a single bundled policy for both home and auto insurance can simplify the renewal process and reduce the administrative burden of dealing with multiple policies.

- Policyholders find it convenient to have one point of contact for all insurance-related queries and claims, enhancing overall customer experience.

- With a bundled policy, updates to coverage or personal information can be easily coordinated across both home and auto insurance components.

Customer Satisfaction Rates

- Research indicates that individuals with bundled insurance policies tend to have higher satisfaction rates compared to those with separate home and auto insurance policies.

- Customer surveys show that policyholders value the cost savings, simplicity, and peace of mind that come with bundling their insurance needs.

- Overall, customer satisfaction rates for individuals with bundled insurance remain consistently positive, reflecting the benefits of this approach.

Claims Process

When it comes to bundled home and auto insurance, understanding the claims process is crucial for policyholders. This process dictates how smoothly and efficiently customers can receive compensation in the event of a covered loss or damage.

Ease of Filing Claims

Filing claims for bundled home and auto insurance policies is typically more convenient compared to separate policies. With a bundled policy, customers only need to go through one insurance provider for both home and auto claims. This means less paperwork, fewer phone calls, and a more streamlined process overall.

For example, if a customer experiences damage to both their home and car due to a single incident, such as a natural disaster, filing a claim under a bundled policy can simplify the entire process.

Streamlining the Claims Process

Bundling home and auto insurance can streamline the claims process by providing a single point of contact for all claims. This can lead to faster resolution times and clearer communication between the policyholder and the insurance company. Additionally, some insurance providers offer discounts or incentives for bundling, which can further enhance the customer experience when filing claims.

Closing Notes

In conclusion, weighing the pros and cons of bundling home and auto insurance policies can lead to significant cost savings and streamlined management. By understanding the discounts, coverage options, and customer satisfaction levels associated with bundled policies, individuals can make informed decisions about their insurance needs.

FAQ Corner

Are there any specific discounts available for bundled home and auto insurance policies?

Insurance companies often offer multi-policy discounts for customers who choose to bundle their home and auto insurance policies together, resulting in cost savings.

How does bundling home and auto insurance affect coverage limits and deductibles?

Bundling insurance policies typically allows for increased coverage limits and reduced deductibles compared to purchasing separate policies, providing enhanced protection for policyholders.

Is managing a single bundled policy more convenient than handling multiple policies separately?

Managing a single bundled policy is generally more convenient for policyholders, as it simplifies the administrative tasks associated with insurance, such as payments, renewals, and claims.