Exploring the distinctions between Auto Policy Quotes and Full Coverage sheds light on important aspects of insurance policies. Let's delve into the nuances of these two options to understand their real differences.

Auto Policy Quotes vs Full Coverage

When it comes to car insurance, understanding the difference between auto policy quotes and full coverage is essential for making informed decisions. Let's break down these two concepts to see what sets them apart.

Auto Policy Quotes

Auto policy quotes are estimates provided by insurance companies detailing the cost of a specific insurance policy for your vehicle. These quotes are based on various factors such as your driving record, age, location, and the type of coverage you choose.

- Auto policy quotes typically include liability coverage, which helps cover costs associated with injuries or property damage to others in an accident where you are at fault.

- They may also include collision coverage, which helps pay for repairs to your vehicle in case of an accident.

- Comprehensive coverage, covering damages caused by events other than collisions, such as theft, vandalism, or natural disasters, may also be part of an auto policy quote.

Full Coverage

Full coverage, on the other hand, refers to a combination of different types of coverage bundled into one comprehensive insurance policy. It provides a higher level of protection compared to basic liability coverage.

- Components included in full coverage often consist of liability coverage, collision coverage, and comprehensive coverage.

- Uninsured/underinsured motorist coverage, which protects you in case of an accident with a driver who has little or no insurance, may also be part of full coverage.

- Personal injury protection (PIP) or medical payments coverage, which covers medical expenses for you and your passengers, might be included in full coverage policies as well.

Factors Influencing Auto Policy Quotes

When it comes to determining auto policy quotes, several factors play a crucial role in influencing the final cost. These factors can vary from personal attributes to vehicle-specific details, all impacting the overall price you pay for your auto insurance coverage.

Personal Factors

- Age: Younger drivers often face higher insurance premiums due to their lack of driving experience and higher likelihood of being involved in accidents.

- Driving History: A clean driving record with no accidents or traffic violations can lead to lower auto policy quotes, as it indicates a lower risk for insurance companies.

- Location: The area where you live can also affect your auto insurance rates, with higher rates in regions with higher crime rates or traffic congestion.

Vehicle Details

- Make and Model: The make and model of your vehicle can impact your auto policy quotes, as luxury or sports cars typically cost more to insure due to their higher repair and replacement costs.

- Age of the Vehicle: Older vehicles might have lower insurance rates compared to newer ones, as they are typically less valuable and cheaper to repair.

Deductibles and Coverage Limits

- Higher deductibles usually lead to lower auto policy quotes, as you agree to pay more out of pocket in case of a claim.

- On the other hand, higher coverage limits mean more protection but can also result in higher premiums as the insurance company is taking on more risk.

Understanding Full Coverage

When it comes to auto insurance, full coverage is a term often used to describe a policy that includes both liability coverage and comprehensive/collision coverage. It provides a higher level of protection compared to basic liability insurance.

Types of Coverage Included in Full Coverage Auto Insurance

- Liability Coverage: This pays for damages and injuries you cause to others in an accident.

- Collision Coverage: This pays for damages to your own vehicle in a collision with another vehicle or object.

- Comprehensive Coverage: This pays for damages to your vehicle that are not the result of a collision, such as theft, vandalism, or natural disasters.

Scenarios Where Full Coverage Would Be Beneficial

- If you have a newer or more valuable vehicle that you want to protect in case of an accident or other unforeseen events.

- If you live in an area prone to theft, vandalism, or severe weather conditions.

- If you have a loan or lease on your vehicle, as lenders often require full coverage to protect their investment.

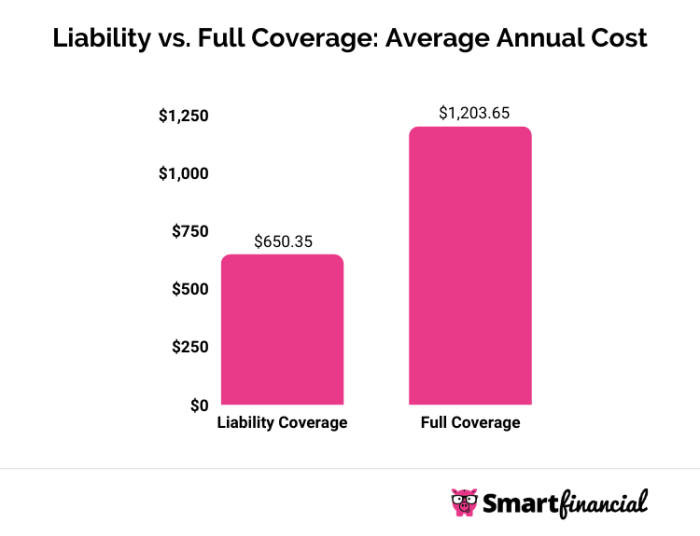

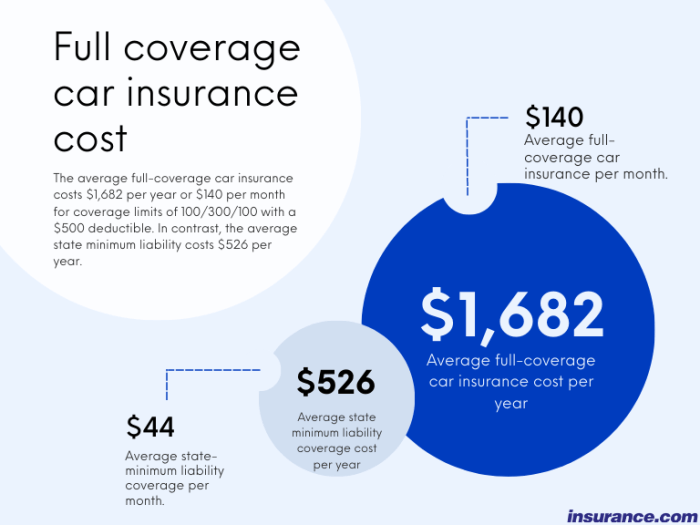

Cost Implications of Opting for Full Coverage

Full coverage auto insurance typically comes with higher premiums compared to basic liability insurance. This is due to the increased level of protection and coverage provided.

It's important to consider your budget and the value of your vehicle when deciding whether to opt for full coverage or stick with a basic policy. While full coverage may cost more upfront, it can save you money in the long run by providing comprehensive protection in various situations.

Coverage Gaps in Auto Policy Quotes vs Full Coverage

When comparing auto policy quotes to full coverage, it is essential to understand the potential coverage gaps that may exist. These gaps can have a significant impact on policyholders in the event of accidents, theft, or natural disasters.

Accidents

- Auto Policy Quotes: Auto policy quotes typically provide coverage for liability only, meaning it may not cover damages to your own vehicle in an accident.

- Full Coverage: Full coverage, on the other hand, includes collision and comprehensive coverage, which can help pay for repairs to your vehicle regardless of fault.

Theft

- Auto Policy Quotes: Basic auto policy quotes may not provide coverage for theft of your vehicle or belongings inside the car.

- Full Coverage: Full coverage often includes theft coverage, offering financial protection if your vehicle is stolen.

Natural Disasters

- Auto Policy Quotes: In the case of natural disasters like hurricanes or floods, standard auto policy quotes may not cover damages to your vehicle.

- Full Coverage: Full coverage typically includes comprehensive coverage, which can help pay for repairs or replacement of your vehicle due to natural disasters.

Understanding these coverage gaps is crucial for policyholders to ensure they have adequate protection in various scenarios.

Ultimate Conclusion

In conclusion, navigating the realm of Auto Policy Quotes and Full Coverage reveals the intricacies of insurance choices. Understanding these differences empowers individuals to make informed decisions regarding their coverage needs.

Popular Questions

What factors influence auto policy quotes?

Auto policy quotes are influenced by personal factors like age, driving history, and location, as well as the vehicle's make, model, and age. Deductibles and coverage limits also play a role in determining the cost.

What are common coverage gaps in auto policy quotes that full coverage addresses?

Common coverage gaps in auto policy quotes include situations like accidents, theft, and natural disasters. Full coverage is designed to provide more comprehensive protection in these scenarios.

Why is it important to understand coverage gaps in insurance policies?

Understanding coverage gaps is crucial as they can impact policyholders during unforeseen events. Being aware of what's included and excluded in your coverage helps you make informed decisions about your insurance needs.