Delve into the complex world of auto insurance quotes with our comprehensive guide. From unraveling the intricacies of insurance premiums to exploring coverage options, this guide will equip you with the knowledge needed to make informed decisions.

Introduction to Auto Insurance Quotations

Auto insurance quotations play a crucial role in helping individuals select the right coverage for their vehicles. By understanding these quotations, you can make informed decisions that best suit your needs and budget.

Purpose of Auto Insurance Quotations

Auto insurance quotations provide an estimate of the cost of insurance coverage based on various factors. This allows individuals to compare different options and choose the most suitable policy for their needs.

Importance of Understanding Quotations

Understanding auto insurance quotations is essential as it helps you determine the coverage you need and ensures you are not overpaying for unnecessary features. By analyzing quotations, you can tailor your policy to fit your specific requirements.

Factors Influencing Auto Insurance Quotes

- Your driving record: A history of accidents or traffic violations can increase your insurance premium.

- The type of vehicle: The make, model, and age of your vehicle can impact the cost of insurance.

- Location: Where you live and park your car can affect the risk of theft or damage, influencing your insurance quote.

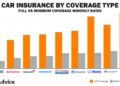

- Coverage options: The level of coverage you choose, such as comprehensive or collision, will impact the overall cost of your insurance policy.

Types of Auto Insurance Coverage

Auto insurance coverage comes in various types to provide different levels of protection for drivers and their vehicles. Understanding these different types of coverage is essential to ensure you have the right insurance for your needs.

Liability Coverage

Liability coverage is a mandatory type of auto insurance that helps pay for damages and injuries you cause to others in an accident. This coverage does not protect your vehicle but helps cover the costs for the other party involved.

Collision Coverage

Collision coverage helps pay for repairs or replacement of your vehicle if it is damaged in a collision with another vehicle or object. This coverage is particularly beneficial for newer or more expensive vehicles.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damages not caused by a collision, such as theft, vandalism, natural disasters, or hitting an animal. This coverage can provide peace of mind for unexpected incidents.

Uninsured/Underinsured Motorist Coverage

This type of coverage helps protect you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover the damages. It can also cover hit-and-run accidents.

Medical Payments Coverage

Medical payments coverage helps pay for medical expenses for you and your passengers if you are injured in an accident, regardless of who is at fault. This coverage can be crucial in covering medical bills quickly.

Rental Reimbursement Coverage

Rental reimbursement coverage helps cover the cost of a rental car if your vehicle is being repaired due to a covered claim. This coverage can be convenient to ensure you have transportation while your car is in the shop.

Factors Affecting Auto Insurance Quotes

When it comes to determining auto insurance quotes, insurance companies take several key factors into consideration. These factors play a significant role in calculating premiums and assessing the level of risk associated with insuring a particular driver.

Age

Age is a crucial factor that insurance companies consider when providing auto insurance quotes. Younger drivers, especially those under the age of 25, are generally considered higher risk due to their lack of driving experience. As a result, younger drivers often face higher insurance premiums compared to older, more experienced drivers.

Driving History

Your driving history is another important factor that can impact your auto insurance quotes. Insurance companies typically look at your past driving record to assess your risk level. A clean driving record with no accidents or traffic violations can lead to lower insurance premiums, while a history of accidents or traffic citations may result in higher rates.

Location

Where you live can also affect your auto insurance quotes. Urban areas with higher rates of traffic congestion and accidents often have higher insurance premiums compared to rural areas. Additionally, factors such as crime rates and weather conditions in your location can also influence the cost of insurance.

Vehicle Type

The type of vehicle you drive can impact your auto insurance quotes as well. Insurance companies consider factors such as the make and model of your car, its safety features, and its likelihood of being stolen when calculating premiums. Sports cars and luxury vehicles typically have higher insurance rates compared to more affordable and safer vehicles.

Tip: To potentially lower your insurance costs, consider factors such as maintaining a clean driving record, choosing a vehicle with safety features, and exploring discounts offered by insurance companies based on your age and location.

Understanding Insurance Premiums

Insurance premiums are the amount of money an individual or business pays for an insurance policy. These premiums are typically paid on a monthly or annual basis and are determined by various factors that assess the level of risk associated with insuring the policyholder.

Calculation of Insurance Premiums

Insurance premiums are calculated based on a variety of factors, including the type of coverage, the amount of coverage, the policyholder's age, driving record, location, and the make and model of the insured vehicle. Insurance companies also take into account the probability of the policyholder filing a claim when determining premiums.

- Insurance companies use complex algorithms and statistical data to assess risk and calculate premiums.

- Factors such as credit score and previous insurance claims history can also impact the cost of premiums.

- Younger drivers and individuals with a history of accidents or traffic violations may face higher premiums due to the increased risk they pose to insurance companies.

Relationship between Deductibles and Premiums

The deductible is the amount of money a policyholder must pay out of pocket before their insurance coverage kicks in. Generally, the higher the deductible, the lower the insurance premium, and vice versa.

For example, if you choose a higher deductible of $1,000 instead of $500, your insurance premium may decrease because you are agreeing to pay a larger portion of any potential claims.

Adjusting Coverage Levels Impact on Premiums

Adjusting coverage levels can significantly affect insurance premiums. Increasing coverage limits or adding additional coverage options will result in higher premiums, while reducing coverage levels can lower premiums.

- For instance, opting for full coverage rather than liability-only coverage will typically lead to higher premiums.

- Conversely, reducing coverage on an older vehicle or increasing deductibles can help lower insurance premiums.

Obtaining and Comparing Auto Insurance Quotes

When it comes to getting auto insurance, obtaining and comparing quotes from different providers is crucial in finding the best coverage at the most competitive price. This process allows you to weigh your options and make an informed decision based on your needs and budget.

The Process of Obtaining Auto Insurance Quotes

When looking for auto insurance quotes, you can reach out to insurance companies directly, visit their websites to request quotes online, or use comparison websites to get multiple quotes at once. You will need to provide information about your vehicle, driving history, and coverage preferences to receive accurate quotes.

The Importance of Comparing Quotes

- Comparing quotes helps you understand the range of coverage options available and the corresponding costs.

- It allows you to identify any gaps in coverage or potential savings by switching providers.

- By comparing quotes, you can ensure you are getting the best value for your money without compromising on coverage.

Tips for Effectively Comparing Quotes

Compare apples to apples

make sure you are comparing similar coverage options and deductibles when evaluating quotes.

- Look beyond the price - consider the reputation of the insurance company, customer reviews, and the ease of claims processing.

- Don't forget discounts - inquire about available discounts that could lower your premium.

- Review the policy details - understand the terms, conditions, and any limitations of each quote before making a decision.

Additional Coverage Options and Discounts

When it comes to auto insurance, there are additional coverage options and discounts that can help you customize your policy and save money.

Optional Coverage Add-Ons

- Roadside Assistance: This coverage provides help if your car breaks down on the road, offering services like towing, fuel delivery, and tire changes.

- Rental Car Reimbursement: If your car is in the shop for repairs after an accident, this coverage helps pay for a rental car so you can still get around.

Common Discounts

- Multi-Policy Discount: Many insurance companies offer discounts if you bundle your auto insurance with another policy, such as homeowners or renters insurance.

- Safe Driver Discount: If you have a clean driving record with no accidents or traffic violations, you may qualify for a discount on your premiums.

- Anti-Theft Device Discount: Installing anti-theft devices like car alarms or tracking systems can lead to lower insurance rates.

How to Qualify for Discounts

- Ask your insurance agent about available discounts and how you can qualify for them.

- Provide proof of eligibility, such as certificates for defensive driving courses or documentation of safety features installed in your vehicle.

Understanding Policy Terms and Conditions

When it comes to auto insurance, understanding the policy terms and conditions is crucial. It involves knowing the specific details of what your policy covers, the limitations, and any exclusions that may apply. By familiarizing yourself with these terms, you can make informed decisions and avoid surprises in the event of a claim.

Common Terms and Conditions

- Deductible: This is the amount you are required to pay out of pocket before your insurance coverage kicks in. A lower deductible typically means higher premiums.

- Liability Coverage: This protects you in case you are at fault in an accident and covers the costs of the other party's property damage or medical expenses.

- Comprehensive Coverage: This type of coverage helps pay for damage to your vehicle that is not caused by a collision, such as theft, vandalism, or natural disasters.

Importance of Reading the Fine Print

- Reading the fine print in your auto insurance policy is essential to fully understand the coverage limitations. It can help you avoid misunderstandings and ensure you are adequately protected.

- Be aware of any specific conditions or requirements that may affect your coverage, such as exclusions related to certain drivers or types of vehicles.

Examples of Policy Exclusions

- Some common policy exclusions include intentional acts, racing, using your vehicle for commercial purposes, and driving under the influence of drugs or alcohol.

- Exclusions may also apply to certain types of damage, such as wear and tear, mechanical breakdowns, or damage from war or nuclear accidents.

Ending Remarks

As we conclude this guide on understanding auto insurance quotations, remember that being well-informed is key to securing the right coverage. Use the insights gained here to navigate the world of auto insurance with confidence and clarity.

FAQ Insights

What factors can impact auto insurance quotes?

Factors such as age, driving history, location, and vehicle type can significantly influence the cost of auto insurance premiums.

How can one potentially lower insurance costs?

To lower insurance costs, consider factors like bundling policies, installing safety devices, and maintaining a clean driving record.

What are common discounts offered by insurance companies?

Common discounts include multi-policy discounts, safe driver discounts, and discounts for installing anti-theft devices.