Shop Car Insurance Quotes on a Budget: Australia Edition sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

When it comes to finding the right car insurance that fits your budget in Australia, there are important factors to consider and tips to keep in mind. This guide will help you navigate through the process smoothly and efficiently.

Shop Car Insurance Quotes on a Budget: Australia Edition

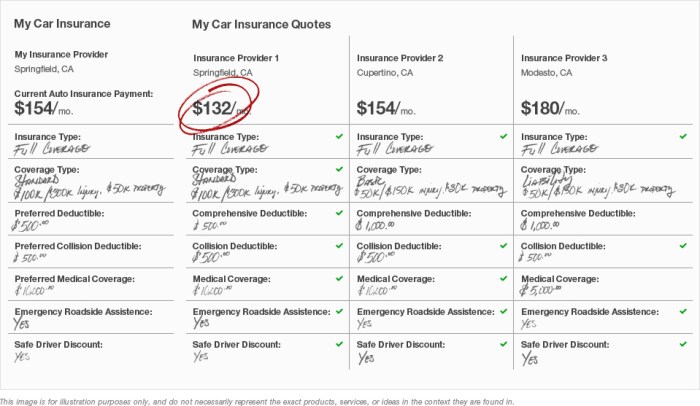

When it comes to car insurance in Australia, comparing quotes is crucial to finding the best coverage at an affordable price. With the variety of options available, taking the time to shop around can help you secure a budget-friendly insurance plan that meets your needs.

The Importance of Comparing Car Insurance Quotes

Comparing car insurance quotes allows you to explore different coverage options and prices offered by various insurance providers. This process helps you make an informed decision and find a policy that not only fits your budget but also provides adequate protection for your vehicle.

Tips for Finding Budget-Friendly Car Insurance Options

- Consider opting for a higher excess amount to lower your premium costs.

- Look for discounts offered by insurance companies, such as multi-policy discounts or safe driver discounts.

- Review your coverage needs and adjust them based on your driving habits to avoid paying for unnecessary features.

- Explore online comparison tools to easily compare quotes from different insurers and find the best deal.

Common Factors that Affect Car Insurance Rates in Australia

- Age and Driving Experience:Younger and less experienced drivers typically face higher insurance premiums.

- Vehicle Type:The make and model of your car can impact your insurance rates, with luxury and high-performance vehicles often costing more to insure.

- Location:Where you live can affect your insurance rates, with higher premiums in areas prone to theft or accidents.

- Driving Record:A history of accidents or traffic violations can lead to increased insurance costs.

Types of Car Insurance in Australia

When it comes to car insurance in Australia, there are several types of coverage available to drivers. Each type offers different levels of protection and comes at varying costs. Understanding the differences between these types of car insurance can help you choose the best option for your needs and budget.

Comprehensive Car Insurance

Comprehensive car insurance is the most extensive type of coverage available in Australia. It provides protection for your own vehicle as well as damage to other vehicles and property. While it is the most expensive option, comprehensive car insurance offers the highest level of protection and peace of mind.

This type of insurance is ideal for new or expensive vehicles, as well as drivers who want maximum coverage.

Third Party Property Damage Insurance

Third Party Property Damage Insurance is the most basic form of car insurance in Australia. It covers damage caused by your vehicle to other vehicles and property. This type of insurance does not cover damage to your own vehicle, so it is typically chosen by drivers with older or less valuable cars who want to meet legal requirements at a lower cost.

Third Party Fire and Theft Insurance

Third Party Fire and Theft Insurance provides coverage for damage to other vehicles and property, as well as protection against fire damage and theft of your own vehicle. This type of insurance is a middle ground between comprehensive and third party property damage insurance, offering additional protection without the high cost of comprehensive coverage.

It is a good option for drivers with vehicles that are at risk of theft or fire damage.

Example Scenarios

- Comprehensive Car Insurance: A driver who has just purchased a brand new car and wants full protection against all possible risks.

- Third Party Property Damage Insurance: A driver with an older car who wants to meet legal requirements for insurance coverage at a lower cost.

- Third Party Fire and Theft Insurance: A driver with a vehicle that is at risk of theft or fire damage but does not want to pay for comprehensive coverage.

Factors to Consider When Shopping for Car Insurance

When shopping for car insurance on a budget in Australia, there are several key factors to consider to ensure you get the right coverage at the right price.Understanding policy coverage limits and exclusions is crucial when selecting car insurance in Australia.

This will help you determine what is included in your policy and what is not covered, allowing you to make an informed decision based on your needs and budget.

Choosing the Right Coverage Limits

- Consider the minimum coverage required by law in Australia to ensure you meet legal requirements.

- Evaluate your driving habits and the level of risk you are willing to take to determine the appropriate coverage limits.

- Assess the value of your car and consider whether comprehensive coverage is necessary or if third-party coverage is sufficient.

Understanding Policy Exclusions

- Pay attention to exclusions related to specific situations, such as driving under the influence or using your car for commercial purposes.

- Review any limitations on coverage for certain events, such as natural disasters or theft, to ensure you are adequately protected.

Tailoring Coverage to Individual Needs

- Consider adding optional extras, such as roadside assistance or rental car coverage, based on your personal preferences and needs.

- Adjust your excess amount to find a balance between upfront costs and potential out-of-pocket expenses in the event of a claim.

- Compare quotes from different insurers to find the best value for your desired level of coverage, taking into account any discounts or promotions available.

Ways to Save on Car Insurance Premiums in Australia

When it comes to car insurance premiums in Australia, there are several strategies you can employ to save money and get the best deal possible. Factors such as age, driving history, and vehicle type can all impact the cost of your car insurance.

By understanding these factors and leveraging discounts and incentives, you can obtain affordable car insurance quotes without compromising on coverage.

Bundling Policies

One way to save on car insurance premiums in Australia is to bundle your policies. Many insurance companies offer discounts if you purchase multiple policies from them, such as combining your car insurance with home or life insurance. By bundling your policies, you can often save money on each individual policy.

Increasing Deductibles

Another strategy to lower your car insurance premiums is to increase your deductibles. By opting for a higher deductible, you are essentially agreeing to pay more out of pocket in the event of a claim. In return, insurance companies often offer lower premiums.

However, it's essential to make sure you can afford the higher deductible if you need to make a claim.

Age, Driving History, and Vehicle Type

Your age, driving history, and the type of vehicle you drive can significantly impact your car insurance costs in Australia. Younger drivers, those with a history of accidents or traffic violations, and owners of high-performance or luxury vehicles typically face higher premiums.

To save money, consider factors like these when shopping for car insurance and be aware of how they may affect your premium.

Leveraging Discounts and Incentives

Insurance companies in Australia often offer various discounts and incentives to attract customers. These can include discounts for good driving behavior, low mileage, or installing safety features in your vehicle. By taking advantage of these discounts and incentives, you can lower your car insurance premiums and potentially save hundreds of dollars each year.

Last Word

In conclusion, navigating the world of car insurance quotes on a budget in Australia requires attention to detail and a strategic approach. By understanding the various types of insurance, key factors to consider, and money-saving tips, you can make informed decisions that protect your vehicle and your finances.

Expert Answers

What are the key factors to consider when shopping for car insurance on a budget in Australia?

When shopping for car insurance on a budget in Australia, key factors to consider include your driving history, the type of coverage you need, your vehicle's make and model, and any discounts available.

How can I save on car insurance premiums in Australia?

You can save on car insurance premiums in Australia by bundling policies, maintaining a good driving record, increasing deductibles, and taking advantage of discounts offered by insurance providers.

Is it important to understand policy coverage limits and exclusions in Australian car insurance?

Yes, it is crucial to understand policy coverage limits and exclusions in Australian car insurance to ensure that you have the necessary protection in case of an accident or unforeseen event.