Navigating the world of car insurance as a high-risk driver in Canada can be daunting. However, with the right tips and strategies at your disposal, it's possible to secure affordable coverage. Let's delve into the realm of discount car insurance quotes tailored specifically for high-risk drivers and explore how to make the most of them.

Understanding High-Risk Drivers

High-risk drivers refer to individuals who are more likely to be involved in accidents or file insurance claims, leading to higher premiums for car insurance coverage. In Canada, several factors contribute to being classified as a high-risk driver, impacting insurance rates and coverage options.

Factors Contributing to High-Risk Classification

- Driving Record: Traffic violations, accidents, and DUI convictions can label a driver as high-risk.

- Age and Experience: Young drivers and those with limited driving experience are often considered high-risk.

- Vehicle Type: Sports cars or vehicles with high theft rates can increase the risk assessment.

- Location: Urban areas with higher traffic congestion and crime rates may result in higher risk classifications.

Statistics on High-Risk Drivers in Canada

According to the Insurance Bureau of Canada, approximately 15% of drivers in the country are classified as high-risk.

In Ontario, high-risk drivers account for about 20% of all insured drivers.

Male drivers under the age of 25 are more likely to be considered high-risk compared to other demographics.

Importance of Discount Car Insurance Quotes

High-risk drivers in Canada should actively seek discount car insurance quotes to alleviate the financial burden associated with their driving record and history. By obtaining quotes tailored to high-risk drivers, individuals can benefit from potential cost savings and more affordable insurance premiums.

Benefits of Discount Car Insurance Quotes for High-Risk Drivers

- Customized Pricing: Discount car insurance quotes take into account the specific circumstances of high-risk drivers, offering personalized pricing that reflects individual driving situations.

- Cost Savings: By comparing multiple discount quotes, high-risk drivers can potentially save a significant amount of money on their car insurance premiums each year.

- Increased Affordability: Discount quotes provide an opportunity for high-risk drivers to find more affordable insurance options that fit their budget constraints.

- Access to Specialized Coverage: Some discount car insurance providers offer specialized coverage options for high-risk drivers, ensuring they have the necessary protection on the road.

Tips for High-Risk Drivers Seeking Discount Car Insurance

As a high-risk driver in Canada, it can be challenging to find affordable car insurance. However, there are strategies you can implement to improve your insurability and lower your insurance premiums, even with a high-risk classification.

Comparing Different Insurers for Discount Quotes

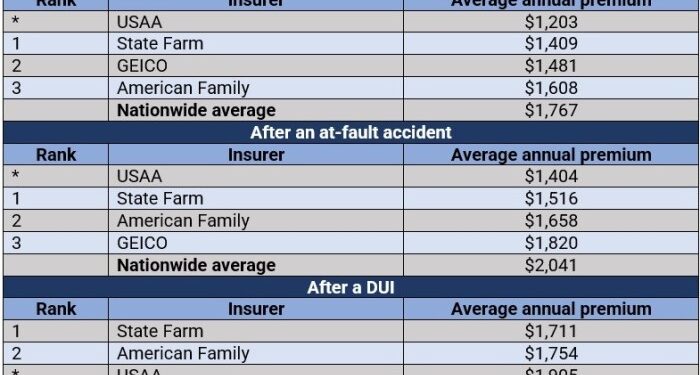

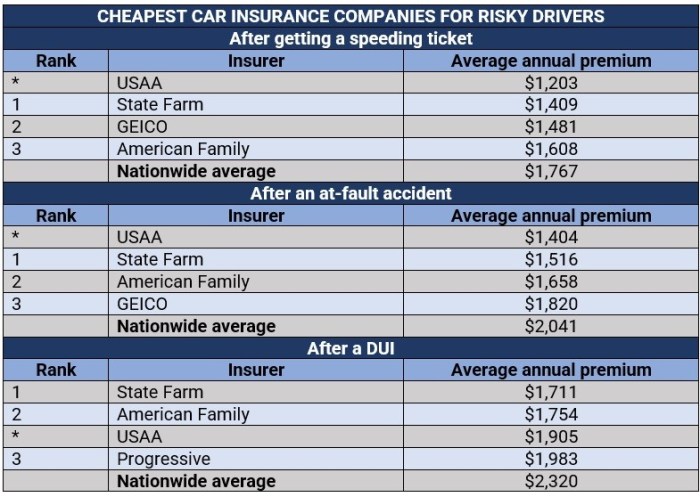

When you are considered a high-risk driver, it is essential to shop around and compare quotes from different insurance providers. Each insurer may assess risk factors differently, which can result in varying premium rates. By obtaining quotes from multiple companies, you can find the best deal tailored to your specific situation.

- Research and compare online quotes from various insurance companies specializing in coverage for high-risk drivers.

- Consider reaching out to insurance brokers who can help you navigate the process and find the most competitive rates.

- Look for insurers that offer discounts or special programs for high-risk drivers, such as defensive driving courses or telematics devices.

Utilizing Comparison Tools

Utilizing comparison tools is crucial for high-risk drivers in Canada who are seeking affordable car insurance quotes. By comparing different options, drivers can find the best deals that suit their specific needs and budget.

How to Effectively Use Online Platforms to Compare Discount Car Insurance Quotes

- Start by researching reputable comparison websites that provide quotes from multiple insurance companies.

- Enter your personal information and details about your vehicle accurately to ensure you receive accurate quotes.

- Compare the coverage options, deductibles, and premiums offered by each insurance provider to determine the best value for your money.

- Take note of any discounts or special offers that may be available to high-risk drivers to further lower your insurance costs.

- Read reviews and ratings of the insurance companies to gauge their customer service and claims handling process.

Step-by-Step Guide on Utilizing Comparison Tools to Find the Best Deals

- Visit a reputable comparison website such as Kanetix or InsuranceHotline that allow you to compare quotes from multiple insurers.

- Fill out the online form with accurate information about yourself and your driving history.

- Review the quotes provided by different insurance companies, paying attention to the coverage limits and premiums offered.

- Select the insurance policy that best fits your needs and budget, taking into consideration any discounts or special offers available.

- Contact the insurance company directly to finalize the policy and ask any additional questions you may have.

Summary

In conclusion, finding suitable car insurance as a high-risk driver in Canada doesn't have to break the bank. By leveraging discount quotes and implementing the provided tips, you can drive with confidence knowing you have the coverage you need at a price you can afford.

User Queries

What factors contribute to being classified as a high-risk driver in Canada?

Factors such as age, driving record, vehicle type, and location can all play a role in determining if you are considered a high-risk driver.

How can high-risk drivers improve their insurability?

High-risk drivers can improve their insurability by taking defensive driving courses, maintaining a clean driving record, and choosing a vehicle with safety features.

Why is it important for high-risk drivers to seek discount car insurance quotes?

Seeking discount car insurance quotes is crucial for high-risk drivers as it can help them find more affordable coverage tailored to their specific needs.