Embark on a journey to explore the world of auto policy quotes in India, learning how to secure the most favorable deals in the market.

Delve into the intricacies of insurance quotes and discover the key factors that can significantly impact your policy costs.

Understanding Auto Policy Quotes

Auto policy quotes play a crucial role in the insurance industry by providing individuals with estimated costs for their desired coverage. These quotes help customers compare different insurance options and make informed decisions based on their budget and needs.

Key Factors Influencing Auto Policy Quotes

- Driving Record: A clean driving record typically results in lower quotes as it indicates a lower risk for the insurance company.

- Vehicle Type: The make and model of the vehicle, as well as its age and safety features, can impact the quote.

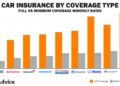

- Coverage Level: The extent of coverage chosen by the customer, such as liability, comprehensive, or collision, will affect the quote.

- Location: The area where the vehicle is primarily parked or driven can influence the quote due to varying risk levels.

Types of Auto Policy Quotes in India

- Third-Party Liability Insurance: This type of policy covers damages caused to a third party in case of an accident involving the insured vehicle.

- Comprehensive Insurance: Offers a wider range of coverage, including damages to the insured vehicle, theft, and third-party liability.

- Personal Accident Cover: Provides financial protection in case of injuries or death of the driver or passengers in the insured vehicle.

Researching Insurance Providers

When looking for the best auto policy quotes in India, it is essential to research and find reputable insurance providers that offer competitive rates and reliable services.

Importance of Checking Credibility and Reviews

- Before choosing an insurance provider, make sure to check their credibility and reputation in the market.

- Reading reviews from other customers can give you insights into the quality of service and claim settlement process of the insurance company.

- Look for ratings and feedback on online platforms to get a better understanding of the insurer's performance.

List of Popular Insurance Providers in India

Here are some well-known insurance companies in India that are known for offering competitive auto policy quotes:

| 1. ICICI Lombard | 5. Bajaj Allianz |

| 2. HDFC ERGO | 6. Reliance General Insurance |

| 3. Tata AIG | 7. Future Generali |

| 4. New India Assurance | 8. United India Insurance |

Factors Affecting Auto Policy Quotes

When it comes to determining auto policy quotes, several factors come into play that can significantly impact the cost of insurance. Understanding these factors is crucial for individuals looking to secure the best deal on their auto insurance.

Personal Factors

- Age: Younger drivers typically face higher insurance premiums due to their lack of driving experience and higher likelihood of being involved in accidents.

- Driving History: A clean driving record with no accidents or traffic violations can lead to lower insurance rates, while a history of accidents or tickets can result in higher premiums.

- Location: The area where you live can also affect your auto policy quotes, with urban areas often having higher rates due to increased traffic congestion and crime rates.

Vehicle Specifications

- Type of Vehicle: The make and model of your car play a significant role in determining insurance costs. Sports cars and luxury vehicles tend to have higher premiums compared to more economical models.

- Vehicle Safety Features: Cars equipped with advanced safety features such as anti-lock brakes, airbags, and anti-theft devices may qualify for discounts on insurance premiums.

Deductibles and Coverage Limits

- Deductibles: Choosing a higher deductible can lower your insurance premiums, but it also means you'll have to pay more out of pocket in the event of a claim.

- Coverage Limits: The amount of coverage you choose for your auto insurance policy can impact the cost of your premiums. Opting for higher coverage limits will result in higher premiums but more financial protection in case of an accident.

Tips for Getting the Best Auto Policy Deal

When it comes to getting the best deal on your auto insurance policy in India, there are several strategies you can use to negotiate with insurance providers, take advantage of discounts, and customize your coverage to fit your individual needs without compromising on protection.

Negotiating with Insurance Providers

When looking for the best auto policy deal, don't hesitate to negotiate with insurance providers. You can often get a better rate by discussing your options and highlighting your eligibility for discounts. Be prepared to compare quotes from different insurers and leverage this information to negotiate a lower premium.

Bundling Policies and Discounts

Consider bundling your auto insurance policy with other insurance products, such as home or health insurance. Insurance providers often offer discounts for customers who purchase multiple policies from them. Additionally, be sure to inquire about any discounts you may be eligible for, such as safe driver discounts or discounts for installing anti-theft devices in your vehicle.

Customizing Coverage

Instead of opting for a standard auto insurance policy, consider customizing your coverage to fit your individual needs. By adjusting your coverage limits, deductibles, and add-on options, you can tailor your policy to provide the right level of protection for your specific circumstances.

This way, you can ensure you are adequately covered without paying for unnecessary features.

Epilogue

In conclusion, mastering the art of navigating auto policy quotes can lead to substantial savings and enhanced coverage tailored to your specific needs.

Helpful Answers

What factors influence auto policy quotes?

Factors such as age, driving history, type of vehicle, deductibles, and coverage limits play a crucial role in determining auto policy costs.

How can I find reputable insurance providers in India?

Research extensively, check reviews, and consider recommendations to identify insurance companies known for offering competitive auto policy quotes.

What strategies can help in negotiating the best auto policy deal?

Negotiate with providers, explore policy bundling options, and leverage available discounts to secure the most favorable insurance deals.