Exploring Discount Car Insurance Quotes: Tips for High-Risk Drivers in Canada, this introduction sets the stage for an informative and engaging discussion.

The following paragraphs will delve into key factors, strategies, coverage options, and steps high-risk drivers in Canada should consider for their car insurance needs.

Factors contributing to high-risk driver classification

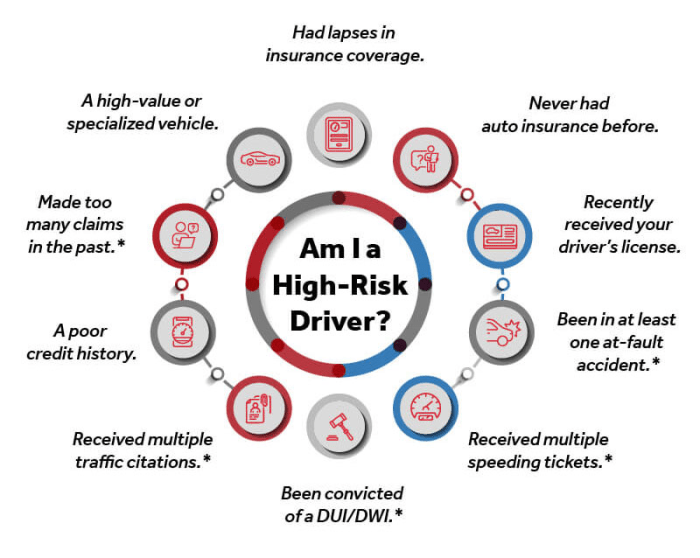

When it comes to determining high-risk drivers in Canada, several factors come into play that can impact your classification and insurance rates.Age, driving history, and the type of vehicle you drive all play a significant role in how insurance companies classify you as a high-risk driver.

Younger and inexperienced drivers are often considered high risk due to their lack of experience on the road. Additionally, individuals with a history of traffic violations or accidents are more likely to be classified as high-risk drivers.Previous claims and traffic violations can also have a direct impact on your insurance rates as they indicate a higher likelihood of future claims.

Insurance companies use this information to assess the level of risk you pose as a driver.For example, if you have a history of speeding tickets, at-fault accidents, or DUI convictions, you are more likely to be classified as a high-risk driver.

Similarly, if you drive a high-performance sports car or a vehicle with a high theft rate, you may also be considered high risk due to the increased likelihood of claims associated with these types of vehicles.

Strategies to lower insurance premiums for high-risk drivers

High-risk drivers often face higher insurance premiums due to their driving history. However, there are strategies that can help lower these costs and make insurance more affordable.

Tips for high-risk drivers to reduce insurance costs

- Focus on improving your driving record by practicing safe driving habits consistently.

- Consider taking defensive driving courses to demonstrate your commitment to safe practices.

- Opt for a higher deductible on your insurance policy to lower your premium costs.

- Bundle your insurance policies with the same provider to potentially qualify for discounts.

- Install safety features in your vehicle to reduce the risk of accidents and lower insurance rates.

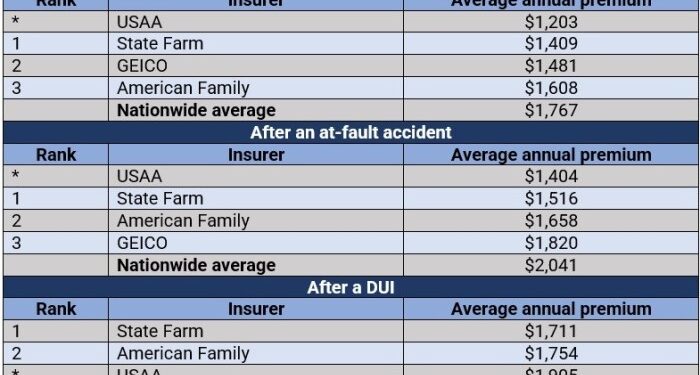

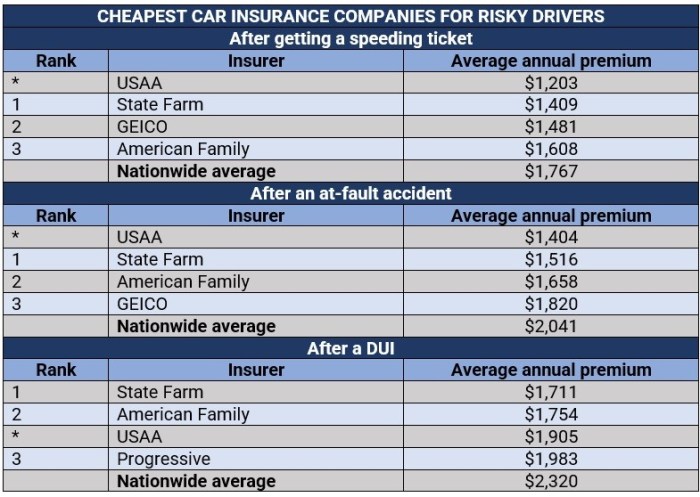

Compare different insurance companies' offerings for high-risk drivers

- Research and compare insurance quotes from multiple providers to find the best rates for high-risk drivers.

- Look for companies that specialize in insuring high-risk drivers, as they may offer competitive rates.

- Consider factors like customer service, coverage options, and discounts when comparing insurance companies.

Discuss the importance of shopping around for the best insurance rates

- Regularly review your insurance policy and shop around for better rates to ensure you are getting the best deal.

- Don't hesitate to switch providers if you find a more affordable option that meets your needs.

- Take advantage of online comparison tools to easily compare insurance rates from different companies.

Provide guidance on leveraging discounts and incentives to lower premiums

- Ask your insurance provider about available discounts for features like anti-theft devices or safe driving records.

- Consider paying your premium annually instead of monthly to potentially save money on administrative fees.

- Explore options for usage-based insurance programs that reward safe driving habits with lower premiums.

Understanding coverage options for high-risk drivers

When it comes to high-risk drivers in Canada, understanding the coverage options available is crucial. Adequate insurance coverage can provide peace of mind and financial protection in case of accidents or other unforeseen events.

Types of coverage available for high-risk drivers

- Basic Coverage: This typically includes mandatory coverage such as liability insurance, which covers damages to other drivers and their vehicles in an accident where you are at fault.

- Comprehensive Coverage: In addition to basic coverage, comprehensive coverage offers protection for damages to your own vehicle due to events like theft, vandalism, or natural disasters.

Importance of adequate coverage for high-risk drivers

Having adequate coverage is essential for high-risk drivers as they face a higher likelihood of accidents or incidents on the road. Without sufficient coverage, high-risk drivers may be left with significant financial burdens in case of a claim.

Additional coverage options for high-risk drivers

- Collision Coverage: This coverage helps pay for damages to your vehicle in case of a collision, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Protects you in case you are involved in an accident with a driver who has insufficient insurance coverage.

- Rental Car Coverage: Provides coverage for a rental car if your vehicle is in the shop for repairs after an accident.

Steps to take after an accident for high-risk drivers

After being involved in an accident, high-risk drivers must act swiftly and responsibly to ensure their safety and protect their insurance status.

Immediate Actions

- Check for injuries and call emergency services if needed.

- Exchange contact and insurance information with the other driver(s).

- Take photos of the accident scene and vehicle damage.

- Notify your insurance company about the accident as soon as possible.

Impact on Insurance Premiums

Accidents can significantly increase insurance premiums for high-risk drivers, as they are already considered a higher risk by insurance companies. The more accidents a driver has on record, the higher their premiums are likely to be.

Claims Process in Canada

When filing a claim after an accident, high-risk drivers should be prepared to provide detailed information about the incident, including the date, time, location, and any relevant photos or documents. Insurance companies will investigate the claim before determining coverage and compensation.

Documenting and Reporting Accidents

- Keep detailed records of the accident, including police reports, witness statements, and medical records if applicable.

- Report the accident to your insurance company promptly and provide all requested information.

- Cooperate with the claims adjuster throughout the process to ensure a smooth resolution.

End of Discussion

In conclusion, Discount Car Insurance Quotes: Tips for High-Risk Drivers in Canada sheds light on navigating the complexities of insurance for drivers facing higher risks, offering valuable insights and guidance for informed decisions.

FAQ Insights

What criteria classify drivers as high-risk in Canada?

Drivers can be classified as high-risk based on factors like age, driving history, type of vehicle, previous claims, and traffic violations.

How can high-risk drivers lower insurance premiums?

High-risk drivers can lower premiums by shopping around, comparing offerings, leveraging discounts, and maintaining a good driving record.

What coverage options are available for high-risk drivers in Canada?

High-risk drivers can choose between basic and comprehensive coverage, ensuring they have adequate protection for various situations.

What immediate actions should high-risk drivers take after an accident?

High-risk drivers should document and report accidents promptly, understanding how it can impact their insurance premiums.