Exploring the intricacies of comparing auto insurance quotes side by side can be a daunting task. This guide aims to simplify the process and provide valuable insights to help you make informed decisions when choosing the right coverage for your vehicle.

From understanding the factors that influence insurance costs to navigating through coverage options and discounts, this guide covers everything you need to know to make a well-informed choice.

Factors to Consider

When comparing auto insurance quote options side by side, it is crucial to take into account various factors that can significantly influence the cost of insurance. Understanding these factors can help you make an informed decision and choose the best policy for your needs.

Age

Age is a key factor that insurance companies consider when determining your auto insurance premium. Younger drivers, especially teenagers, tend to pay higher premiums due to their lack of driving experience and higher risk of accidents. On the other hand, older drivers may also face higher rates as they are more prone to certain health conditions that could affect their driving abilities.

Location

Your location plays a significant role in determining your auto insurance quote. Urban areas with higher population densities and increased traffic tend to have higher rates compared to rural areas. Additionally, areas prone to theft, vandalism, or severe weather conditions may also result in higher premiums.

Driving History

Your driving history is another critical factor that insurance companies consider. A clean driving record with no accidents or traffic violations can lead to lower insurance rates, as it demonstrates responsible driving behavior. Conversely, a history of accidents, speeding tickets, or DUI convictions can result in higher premiums, as it indicates a higher risk of future claims.

Coverage Options

When comparing auto insurance quote options side by side, it's crucial to understand the various coverage options available. These options can significantly impact the overall quote you receive. Here, we will discuss common types of coverage options, including liability, comprehensive, and collision coverage, and how each choice affects your insurance premium.

Liability Coverage

- Liability coverage is mandatory in most states and covers the costs associated with injuries or property damage that you are legally responsible for in an accident.

- It typically includes bodily injury liability and property damage liability limits, such as $50,000 per person/$100,000 per accident for bodily injury and $25,000 for property damage.

- Choosing higher liability limits will result in a higher premium, but it provides more protection in case of a severe accident.

Comprehensive Coverage

- Comprehensive coverage protects your vehicle from non-collision incidents, such as theft, vandalism, fire, or natural disasters.

- It often includes a deductible, which is the amount you must pay out of pocket before the insurance kicks in.

- Adding comprehensive coverage to your policy can increase your premium, but it provides valuable protection for your vehicle.

Collision Coverage

- Collision coverage pays for the repair or replacement of your vehicle if it's damaged in a collision with another vehicle or object.

- Similar to comprehensive coverage, collision coverage also comes with a deductible that you must pay before the insurance covers the rest.

- Opting for collision coverage can raise your premium, but it ensures that your vehicle is protected in case of an accident.

Deductibles and Limits

When comparing auto insurance quotes, understanding deductibles and limits is crucial to making an informed decision. Deductibles are the amount you agree to pay out of pocket before your insurance kicks in to cover the rest of the claim. Limits, on the other hand, refer to the maximum amount your insurance will pay for a covered claim.

Relationship Between Deductibles, Limits, and Premium Costs

Adjusting your deductibles and limits can have a direct impact on your premium costs. Typically, choosing a higher deductible will lower your premium since you are agreeing to pay more out of pocket in the event of a claim. On the other hand, increasing your coverage limits will usually result in a higher premium since the insurance company is taking on more risk.

- Increasing your deductible from $500 to $1,000 can lead to a decrease in your premium by as much as 25%.

- Raising your liability coverage limits from the state minimum to higher amounts can result in a higher premium, but it provides better protection in case of a serious accident.

- Lowering your comprehensive and collision coverage limits can lower your premium, but it also means you'll receive less compensation in the event of damage to your vehicle.

Discounts and Savings

When comparing auto insurance quotes, it's crucial to look into the various discounts offered by insurance companies. These discounts can help you save money on your premiums and make your policy more affordable.

Bundling Policies

- One common discount is bundling policies, where you combine your auto insurance with another type of insurance, such as homeowners or renters insurance. Insurance companies often offer discounts for bundling policies, making it a cost-effective option.

- By bundling your policies, you can save money on each individual policy and simplify your insurance needs by having them all in one place.

Good Driving Record

- Having a good driving record is another way to qualify for discounts on your auto insurance. Insurance companies reward safe drivers with lower premiums because they are considered less risky to insure.

- By maintaining a clean driving record, you demonstrate to insurance companies that you are a responsible driver, which can lead to significant savings on your insurance premiums.

Exploring Discount Options

- It's important to thoroughly explore all discount options when comparing auto insurance quotes. Some discounts may not be immediately obvious, so it's worth asking your insurance agent about any available discounts you may qualify for.

- By taking the time to investigate discount opportunities, you can ensure that you are getting the best possible rate on your auto insurance policy.

Reviewing Quotes

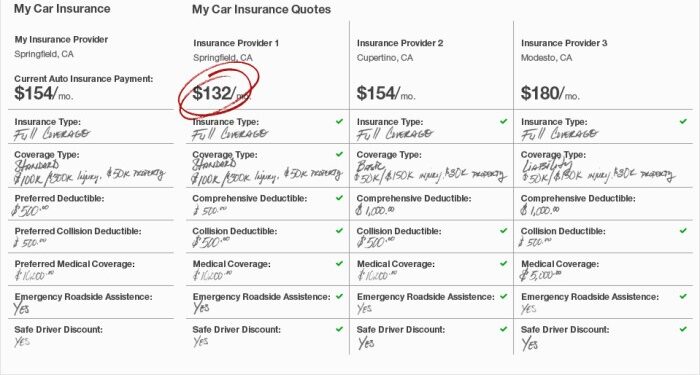

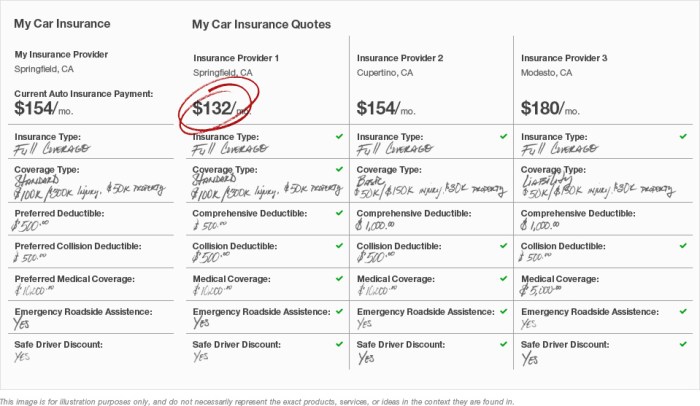

When it comes to comparing auto insurance quotes, obtaining and reviewing multiple quotes is crucial to finding the best coverage at the right price. Here are some tips on how to effectively compare quotes side by side and why looking beyond just the price is essential.

Tips for Comparing Quotes

- Request quotes from at least three different insurance companies to get a comprehensive view of available options.

- Compare coverage limits, deductibles, and types of coverage offered to ensure you are getting the protection you need.

- Look for any exclusions or limitations in the coverage that could impact your decision.

- Consider the reputation and customer service of each insurance company to gauge their reliability in handling claims.

Importance of Coverage Details

- While price is important, it should not be the sole factor in your decision-making process. Cheaper insurance may come with limited coverage, leaving you vulnerable in case of an accident.

- Review the specific coverage details, such as liability limits, comprehensive and collision coverage, and any additional benefits like roadside assistance or rental car reimbursement.

- Understanding the coverage you are getting will help you make an informed decision based on your individual needs and preferences.

Last Recap

In conclusion, comparing auto insurance quote options side by side allows you to make a more informed decision about the coverage that best suits your needs. By considering factors like deductibles, coverage limits, and available discounts, you can ensure that you are adequately protected while saving money.

Take the time to review and compare quotes carefully to find the best deal for your auto insurance needs.

Quick FAQs

What factors affect auto insurance quotes?

Factors like age, location, driving history, and type of vehicle can impact auto insurance quotes.

How does the choice of coverage affect the overall quote?

The type of coverage you choose, such as liability, comprehensive, or collision, can influence the cost of your auto insurance quote.

What are deductibles and coverage limits in auto insurance?

Deductibles are the amount you pay out of pocket before your insurance coverage kicks in, while coverage limits are the maximum amount your insurer will pay for a covered loss.

How can adjusting deductibles and limits impact insurance quotes?

Adjusting deductibles and coverage limits can affect the cost of your insurance premium, as higher deductibles typically result in lower premiums.

Why is it important to explore discount options when comparing quotes?

Exploring discount options can help you save money on your auto insurance by taking advantage of available savings opportunities.