Embarking on the journey of understanding car insurance quotes and lowering premiums quickly is essential for savvy consumers looking to save money while getting the coverage they need. In this guide, we will explore the key components of car insurance quotes, effective ways to shop for quotes, and strategies to lower premiums efficiently.

Let's dive in and demystify the world of car insurance!

Understanding Car Insurance Quotes

When shopping for car insurance, it's important to understand the various components of a car insurance quote to make an informed decision and potentially lower your premiums.

Components of a Car Insurance Quote

- The premium: This is the amount you pay for your insurance coverage, typically on a monthly or annual basis.

- Deductibles: The amount you agree to pay out of pocket before your insurance kicks in.

- Coverage limits: The maximum amount your insurance will pay out for covered claims.

- Types of coverage: Liability, collision, comprehensive, uninsured/underinsured motorist, and more.

Factors Influencing Premium Rates

- Driving record: A history of accidents or traffic violations can lead to higher premiums.

- Vehicle make and model: Some cars are more expensive to insure due to factors like theft rates or repair costs.

- Age and gender: Younger drivers and males typically pay higher premiums.

- Location: Urban areas with higher rates of accidents or theft may result in higher premiums.

Importance of Comparing Quotes

- Price variation: Different insurance providers offer varying rates for the same coverage, so comparing quotes can help you find the best deal.

- Coverage options: Comparing quotes allows you to review different coverage options and choose the one that best fits your needs.

- Potential discounts: Some insurers may offer discounts that others don't, so shopping around can help you find additional savings.

How to Shop for Car Insurance Quotes

When looking for car insurance, it's essential to gather multiple quotes to find the best coverage at the most competitive price. Here are some tips on how to shop for car insurance quotes effectively:

Gathering Multiple Quotes Efficiently

- Utilize online comparison tools: Websites like Compare.com, NerdWallet, and The Zebra allow you to compare quotes from multiple insurance companies in one place.

- Reach out to insurance companies directly: Contact insurance providers individually or visit their websites to request quotes tailored to your specific needs.

- Consider using an insurance broker: Insurance brokers can help you navigate the insurance market and find the best coverage options based on your requirements.

Lowering Premiums on Car Insurance

To reduce the cost of your car insurance premiums, there are several strategies you can implement. Understanding the factors that influence your premium can help you make informed decisions to lower your costs.

Impact of Deductibles

When you select a higher deductible on your car insurance policy, you are agreeing to pay more out of pocket in the event of a claim. However, opting for a higher deductible can result in lower premium costs. By taking on more financial responsibility upfront, insurance companies typically offer lower premium rates.

It's essential to assess your financial situation and risk tolerance to determine the appropriate deductible for your needs.

Role of Discounts

Insurance companies often provide a variety of discounts that can help lower your premium costs

Taking advantage of these discounts can significantly reduce your overall insurance expenses.

Factors Influencing Car Insurance Premiums

When it comes to determining car insurance premiums, several factors come into play. These factors can significantly impact how much you pay for coverage. Let's delve into some key factors that influence car insurance premiums.

Driving History and Premium Rates

Your driving history plays a crucial role in determining your car insurance premium rates. Insurance companies assess your past driving record to gauge your risk as a driver. If you have a history of accidents, traffic violations, or DUI convictions, you are considered a high-risk driver, which leads to higher premiums.

On the other hand, a clean driving record with no accidents or violations can result in lower premium rates.

- Accidents and Traffic Violations: Being involved in accidents or receiving traffic citations can increase your insurance premiums significantly.

- DUI Convictions: Driving under the influence (DUI) convictions can have a substantial impact on your insurance rates due to the increased risk associated with impaired driving.

- Driving Experience: Inexperienced drivers, such as teenagers or individuals with a limited driving history, often face higher insurance premiums.

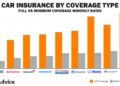

Type of Coverage and Premium Impact

The type of coverage you select for your car insurance policy can also affect your premiums. Different coverage options offer varying levels of protection, and the more comprehensive the coverage, the higher the premiums tend to be.

- Liability Coverage: Basic liability coverage is typically the most affordable option but offers limited protection. Adding comprehensive and collision coverage can increase premiums but provides more extensive coverage for your vehicle.

- Uninsured/Underinsured Motorist Coverage: Opting for this additional coverage can also impact your premiums, as it offers protection in case you are involved in an accident with a driver who lacks sufficient insurance coverage.

- Personal Injury Protection (PIP): This coverage pays for medical expenses and lost wages for you and your passengers, and choosing to include PIP in your policy can result in higher premiums.

Vehicle Make and Model Impact on Insurance Costs

The make and model of your vehicle can significantly influence your insurance costs. Insurance companies consider factors such as the car's value, repair costs, safety features, and theft rates when determining premiums.

- Vehicle Value: High-value vehicles typically have higher insurance premiums due to the increased cost of repairs or replacement.

- Safety Features: Cars equipped with advanced safety features may qualify for discounts on insurance premiums, as they are considered less risky to insure.

- Theft Rates: Vehicles that are more likely to be stolen can result in higher insurance premiums to offset the risk of theft.

Concluding Remarks

As we conclude our exploration of how to shop car insurance quotes and lower premiums fast, it becomes evident that with the right knowledge and tools, consumers can make informed decisions to optimize their insurance coverage while saving money. By comparing quotes, understanding factors that influence premiums, and implementing cost-saving strategies, individuals can secure the best possible car insurance deals.

Start your journey to smarter car insurance shopping today!

Key Questions Answered

How can I effectively compare car insurance quotes?

To efficiently compare car insurance quotes, use online comparison tools, provide accurate information, and consider both coverage options and premium rates.

What are some common discounts that can help lower insurance costs?

Common discounts include safe driver discounts, multi-policy discounts, and vehicle safety feature discounts. Check with your provider to see which discounts you may qualify for.

How do deductibles impact car insurance premiums?

Choosing a higher deductible typically lowers your premium but means you'll pay more out of pocket in the event of a claim. A lower deductible usually results in higher premiums but lower out-of-pocket costs.