Embarking on the journey of finding the right car insurance can be daunting. With the abundance of options available, it's crucial to utilize online tools effectively to streamline the process. This guide will walk you through the essentials of shopping for car insurance online, ensuring you make informed decisions tailored to your needs.

Researching Car Insurance Options

Researching car insurance options is crucial to finding the best coverage that suits your needs and budget. By exploring different insurance policies, you can make an informed decision and ensure you have adequate protection in case of an accident or other unforeseen events.

Key Factors to Consider When Comparing Insurance Policies

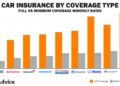

- Coverage Options: Assess the types of coverage offered, such as liability, collision, comprehensive, and personal injury protection.

- Premium Costs: Compare the cost of premiums for different policies and consider any discounts or incentives available.

- Deductibles: Evaluate the deductible amounts for each policy and choose one that aligns with your financial situation.

- Customer Reviews: Look for feedback from current or past customers to gauge the quality of service and claims handling.

Tips for Effective Research on Car Insurance Providers

- Utilize Comparison Websites: Use online tools to compare quotes from multiple insurance companies to find the best rates.

- Contact Agents Directly: Reach out to insurance agents to ask specific questions and clarify any details about their policies.

- Read Policy Documents Carefully: Review the terms and conditions of each policy to understand coverage limits, exclusions, and restrictions.

- Consider Local Providers: Explore options from local insurance companies that may offer personalized service and tailored coverage.

Utilizing Online Comparison Tools

When it comes to shopping for car insurance, utilizing online comparison tools can be a game-changer. These tools allow you to easily compare rates and coverage options from various insurance providers, helping you find the best deal that suits your needs and budget.

Benefits of Using Online Comparison Tools

- Save Time: Instead of contacting each insurance company individually, you can compare multiple quotes in one place, saving you time and effort.

- Save Money: By comparing rates from different providers, you can find the most competitive prices and potentially save money on your car insurance.

- Easy Comparison: Online tools provide a side-by-side comparison of rates and coverage options, making it easier to see the differences and make an informed decision.

- Convenience: You can access these tools anytime, anywhere, from the comfort of your home or on the go, making the process of shopping for car insurance more convenient.

Popular Online Tools for Comparing Car Insurance Rates

- Insurance.com:Offers a simple interface to compare quotes from multiple providers.

- The Zebra:Allows you to compare rates from over 200 insurance companies to find the best deal.

- NerdWallet:Provides personalized car insurance quotes based on your needs and preferences.

Step-by-Step Guide to Using an Online Comparison Tool

- Enter Your Zip Code: Start by entering your zip code to get accurate quotes based on your location.

- Provide Vehicle Information: Input details about your car, including make, model, and year.

- Enter Personal Details: Fill in your personal information, such as age, driving history, and coverage preferences.

- Compare Quotes: Once you have entered all the necessary information, compare quotes from different insurance providers to find the best option for you.

- Select a Plan: Choose the car insurance plan that offers the coverage you need at a price that fits your budget.

Understanding Coverage Needs

When it comes to car insurance, understanding your coverage needs is crucial to ensure you are adequately protected in case of an accident or unexpected event. Different types of coverage options are available, each serving a specific purpose based on individual circumstances.

Types of Car Insurance Coverage

- Liability Coverage: This type of coverage helps pay for damages and injuries you cause to others in an accident.

- Collision Coverage: Covers the cost of repairing or replacing your car after an accident, regardless of fault.

- Comprehensive Coverage: Protects your vehicle from non-collision incidents like theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Steps in when the at-fault driver doesn't have insurance or enough coverage to pay for damages.

Determining Appropriate Coverage

- Assess Your Vehicle: Consider the age, value, and condition of your car to determine the level of coverage needed.

- Evaluate Your Driving Habits: If you have a long commute or frequently drive in high-traffic areas, you may need more comprehensive coverage.

- Review State Requirements: Make sure you meet the minimum insurance requirements set by your state.

Understanding Policy Limits and Deductibles

- Policy Limits: This refers to the maximum amount your insurance provider will pay for a covered claim. It's essential to choose limits that adequately protect your assets and financial well-being.

- Deductibles: The deductible is the amount you pay out of pocket before your insurance coverage kicks in. Opting for a higher deductible can lower your premiums but may require you to pay more in case of an accident.

Obtaining Multiple Quotes

When shopping for car insurance, it is crucial to obtain multiple quotes from different insurers before making a decision. This allows you to compare prices and coverage options, ensuring you get the best deal for your needs.

Advantages of Obtaining Multiple Quotes

- Ensures you get competitive rates and discounts

- Helps you find the most suitable coverage for your budget

- Gives you a comprehensive view of available options in the market

Tips on Requesting and Comparing Quotes

- Provide accurate and consistent information to each insurer

- Ask about available discounts or promotions

- Compare not only prices but also coverage details, deductibles, and exclusions

- Consider the reputation and customer service of the insurance companies

Significance of Comparing Coverage Details

It is essential to not only focus on the price when comparing insurance quotes. Pay close attention to the coverage details, deductibles, and limits offered by each insurer. A lower price may not always mean better coverage, so make sure to evaluate all aspects before making a decision.

Final Thoughts

In conclusion, navigating the world of car insurance can be simplified with the right tools at your disposal. By understanding how to leverage online resources effectively, you can secure the best coverage for your vehicle while saving time and money.

Take charge of your insurance decisions today and drive with confidence knowing you're protected on the road.

FAQ Summary

What are the key factors to consider when comparing different insurance policies?

Some key factors to consider include coverage limits, deductibles, premiums, and any additional benefits offered by the insurance provider.

How can I effectively research and gather information about car insurance providers?

You can utilize online reviews, company websites, and independent rating agencies to gather information about car insurance providers.

Why is it important to understand policy limits and deductibles when shopping for car insurance?

Understanding policy limits and deductibles is crucial as they determine the extent of coverage and the out-of-pocket expenses you may incur in case of an accident.