When it comes to purchasing a new vehicle, one crucial step that often gets overlooked is shopping for car insurance. Understanding the ins and outs of finding the right coverage can be a game-changer in protecting your investment. Let's delve into the essentials of shopping for car insurance after buying a new vehicle.

As we navigate through the intricacies of insurance providers, coverage options, and cost-saving strategies, you'll gain valuable insights to make informed decisions that suit your needs.

Researching Car Insurance Providers

When shopping for car insurance after buying a new vehicle, it is crucial to research and compare different car insurance providers to find the best coverage options, premiums, and discounts. Choosing a reputable insurance company is essential to ensure reliable coverage and excellent customer service.

Identify Top Car Insurance Providers

- State Farm

- GEICO

- Progressive

- Allstate

- USAA

Compare Coverage Options, Premiums, and Discounts

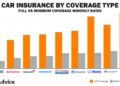

- Review the types of coverage offered by each provider, such as liability, collision, comprehensive, and personal injury protection.

- Compare premiums to find a balance between affordable rates and sufficient coverage for your needs.

- Look for discounts available, such as safe driver discounts, multi-policy discounts, and good student discounts.

Importance of Choosing a Reputable Insurance Company

- Reputable insurance companies have a track record of financial stability and prompt claims processing.

- Customer reviews and ratings can give insight into the quality of service provided by an insurance company.

- Choosing a reputable provider can give you peace of mind knowing that your insurance needs will be met in case of an accident or other covered event.

Understanding Insurance Requirements

When it comes to car insurance, it's crucial to understand the specific requirements in your state and the different types of coverage available to protect your new vehicle. Let's delve into the details below.

Minimum Car Insurance Requirements

Each state has its own set of minimum car insurance requirements that drivers must adhere to. These typically include:

- Bodily Injury Liability: Coverage for injuries caused to another person in an accident where you are at fault.

- Property Damage Liability: Coverage for damages to another person's property in an accident where you are at fault.

- Uninsured/Underinsured Motorist: Coverage to protect you in case of an accident with a driver who doesn't have insurance or enough coverage.

Types of Coverage Available

Aside from the minimum requirements, there are various types of coverage available to enhance protection for your vehicle:

- Comprehensive Coverage: Protection for non-collision damages such as theft, vandalism, or natural disasters.

- Collision Coverage: Coverage for damages to your vehicle in a collision with another vehicle or object.

- Personal Injury Protection (PIP): Coverage for medical expenses and lost wages for you and your passengers.

Coverage Based on Vehicle Type

The type of vehicle you purchase can impact the coverage needs. For example:

- New Vehicles: It's common to opt for comprehensive and collision coverage to protect your investment.

- Used Vehicles: Drivers may choose to adjust coverage based on the value and age of the vehicle.

- Luxury Vehicles: Additional coverage may be necessary to cover high repair costs and specialized parts.

Factors Affecting Insurance Rates

When it comes to determining insurance rates for a new vehicle, several factors come into play. These factors can significantly impact the amount you pay for your insurance premiums. Understanding these variables can help you make informed decisions and potentially save money on your insurance costs.

Driving Record, Age, Location, and Type of Vehicle

- Your driving record plays a crucial role in determining your insurance rates. A clean record with no accidents or traffic violations can lead to lower premiums, as it demonstrates responsible driving behavior.

- Your age is another factor that insurance companies consider. Younger drivers typically face higher insurance rates due to their lack of experience on the road.

- Where you live also affects your insurance premiums. Urban areas with higher rates of accidents and theft may result in higher insurance costs compared to rural areas.

- The type of vehicle you drive can impact your insurance rates as well. Sports cars and luxury vehicles tend to have higher premiums due to their higher repair costs and increased likelihood of theft.

Make and Model of a New Vehicle

The make and model of your new vehicle can influence your insurance premiums significantly. Insurance companies consider factors such as the cost of repairs, safety features, theft rates, and overall risk associated with a particular make and model when calculating your insurance rates.

For example, a brand-new luxury SUV may have higher insurance premiums compared to a budget-friendly sedan due to the higher cost of repairs and replacement parts.

Strategies to Lower Insurance Costs

- Consider opting for a higher deductible. A higher deductible can lower your premiums, but make sure you can afford the out-of-pocket costs in case of an accident.

- Bundle your home and auto insurance policies with the same provider. Many insurance companies offer discounts for bundling multiple policies.

- Take advantage of available discounts, such as safe driver discounts, low mileage discounts, or discounts for safety features installed in your vehicle.

- Shop around and compare quotes from multiple insurance providers to find the best rate for your new vehicle.

Obtaining Insurance Quotes

When it comes to getting insurance quotes for your new vehicle, it's essential to follow a systematic approach to ensure you get the best coverage at a competitive price. Here's a step-by-step guide on how to request insurance quotes and compare them effectively.

Requesting Insurance Quotes

- Start by gathering all the necessary information about your vehicle, including make, model, year, and VIN number.

- Visit the websites of various insurance companies or use online comparison tools to request quotes.

- Fill out the required details accurately, such as your driving history, coverage preferences, and personal information.

- You can also contact insurance agents directly to request quotes and discuss your options.

Comparing Insurance Quotes

- Once you receive quotes from multiple insurers, compare the coverage limits, deductibles, and premiums offered.

- Consider the reputation and financial stability of the insurance companies before making a decision.

- Look for any additional benefits or discounts that may be included in the quotes.

- Choose a policy that provides adequate coverage for your needs at a price that fits your budget.

Importance of Accuracy

It's crucial to provide accurate information when obtaining insurance quotes to ensure that the quotes you receive are realistic and reflective of your actual situation. Inaccurate information can lead to discrepancies in coverage and premiums, potentially causing issues in the event of a claim.

Always double-check the details you provide to get the most accurate insurance quotes for your new vehicle.

Coverage Add-Ons and Special Considerations

When it comes to insuring a new vehicle, there are several coverage add-ons and special considerations that can enhance your insurance policy and provide you with extra protection. These add-ons can offer peace of mind and financial security in various situations.

Roadside Assistance

Roadside assistance is a valuable add-on that can provide you with help in case your vehicle breaks down on the side of the road. Whether it's a flat tire, dead battery, or running out of gas, having roadside assistance coverage can save you time and stress.

This service usually includes towing, jump-starts, fuel delivery, and more.

Rental Car Reimbursement

Rental car reimbursement is another useful add-on that can cover the cost of a rental vehicle if your car is in the shop for repairs after an accident. This coverage can help you stay mobile and continue with your daily activities while your car is being fixed.

It's a convenient option that can prevent any disruptions to your routine.

Gap Insurance

Gap insurance is particularly important for new vehicles as it covers the "gap" between what you owe on your car loan and the actual cash value of your vehicle in case of a total loss. This add-on can prevent you from having to pay out of pocket for the remaining balance on your loan if your car is declared a total loss.

New Car Replacement Coverage

New car replacement coverage is designed specifically for new vehicles and can help you replace your car with a brand new one of the same make and model if it's totaled in an accident. This coverage ensures that you can get back on the road with a similar vehicle without the depreciation that occurs with time.

Bundling Insurance Policies

Bundling insurance policies for multiple vehicles or combining your auto insurance with other types of insurance, such as home or life insurance, can lead to significant savings. Insurance companies often offer discounts for bundling policies, making it a cost-effective option for comprehensive coverage across different aspects of your life.

Final Review

In conclusion, shopping for car insurance after acquiring a new vehicle is not just about meeting legal requirements—it's about safeguarding your prized possession and ensuring peace of mind on the road. By following the guidelines Artikeld here, you're well-equipped to make sound choices that align with your budget and protection goals.

FAQ Insights

What are the minimum car insurance requirements in my state?

Minimum car insurance requirements vary by state, but typically include liability coverage. It's essential to check your specific state's regulations to ensure compliance.

How can I lower insurance costs for my new vehicle?

You can potentially lower insurance costs by maintaining a clean driving record, choosing a vehicle with safety features, and bundling policies with the same provider for discounts.

What is gap insurance for a new vehicle?

Gap insurance covers the difference between what you owe on your car loan and the car's current value in case of a total loss. It can be beneficial for new vehicles.