Exploring the realm of Top Bundle Insurance Quotes for Families in 2025, this introduction aims to provide a detailed overview of the subject matter. It delves into the importance of bundle insurance, the factors families should consider, and the top providers to look out for.

Furthermore, it sheds light on the technological trends that are reshaping the insurance landscape and how they might impact families seeking insurance coverage in the near future.

Introduction to Bundle Insurance Quotes

Bundle insurance is a type of insurance that combines multiple policies into one comprehensive package, offering coverage for various aspects such as home, auto, and life insurance. For families, bundle insurance can provide cost savings, convenience, and simplified management of multiple policies under one provider.

Benefits of Bundle Insurance for Families

- Cost-Effectiveness: By bundling different insurance policies together, families can often benefit from discounted rates and overall cost savings compared to purchasing individual policies separately.

- Convenience: Managing multiple insurance policies can be challenging and time-consuming. Bundle insurance streamlines this process by consolidating all policies under one provider, making it easier to track coverage and make payments.

- Customized Coverage: Bundle insurance allows families to tailor their coverage to meet their specific needs, ensuring they have adequate protection across different areas of their lives.

Importance of Comparing Quotes

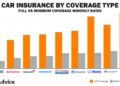

When considering bundle insurance for families, it's crucial to compare quotes from different providers to find the best coverage at the most competitive rates. By comparing quotes, families can ensure they are getting the most value for their money and identify any gaps in coverage that need to be addressed.

Factors to Consider in Bundle Insurance Quotes

When evaluating bundle insurance quotes for families, there are several key factors to consider to ensure the coverage meets their specific needs and circumstances. Understanding these factors can help families make informed decisions when choosing insurance coverage.One important factor to consider is the coverage offered in the bundle insurance quotes.

Families should carefully review what types of insurance are included in the bundle, such as home, auto, and life insurance, to ensure they have comprehensive coverage for their assets and loved ones.Another factor to evaluate is the deductibles associated with the insurance quotes.

Families should consider how much they would be responsible for paying out of pocket before the insurance coverage kicks in. Choosing a higher deductible can lower premiums but may result in higher out-of-pocket costs in the event of a claim.Premiums are also a crucial factor to consider when comparing bundle insurance quotes.

Families should assess the total cost of the insurance bundle and determine if it fits within their budget while providing adequate coverage for their needs.In addition to the basic coverage included in the bundle insurance, families may also need to customize their insurance with add-ons or riders.

Common add-ons include umbrella liability coverage, identity theft protection, and pet insurance. Families should evaluate these additional options based on their specific circumstances and risks.Ultimately, the family's specific needs and circumstances should heavily influence the choice of insurance coverage. Factors such as the number of family members, the value of assets, driving records, and health conditions should all be taken into account when selecting the right bundle insurance quotes for maximum protection and peace of mind.

Top Bundle Insurance Providers for Families in 2025

In today's insurance market, families have a wide range of options when it comes to bundle insurance providers. These companies offer a variety of coverage options, pricing structures, and customer service experiences. Let's take a closer look at some of the top bundle insurance providers for families in 2025.

1. Allstate

Allstate is known for its comprehensive coverage options, including auto, home, and life insurance bundles. They offer competitive pricing and have a strong reputation for excellent customer service. Allstate also stands out for its innovative Drivewise program, which rewards safe driving habits with discounts on premiums.

2

. State Farm

State Farm is another popular choice for families looking to bundle their insurance policies. They provide a wide range of coverage options, personalized service, and a user-friendly claims process. State Farm's Drive Safe & Save program is a unique feature that allows policyholders to save money based on their driving behavior.

3. Progressive

Progressive is known for its flexibility and customizable bundle options for families. They offer competitive pricing, a variety of discounts, and 24/7 customer support. Progressive's Snapshot program is a cutting-edge feature that uses telematics technology to track driving habits and reward safe drivers with lower premiums.

4. Geico

Geico is a popular choice for families seeking affordable bundle insurance options. They are known for their straightforward pricing, easy-to-use online tools, and responsive customer service. Geico's DriveEasy app is a standout feature that provides personalized feedback on driving habits and offers potential savings on insurance premiums.

5. Liberty Mutual

Liberty Mutual offers a range of bundle insurance options for families, including auto, home, and life coverage. They are known for their competitive rates, customizable policies, and dedicated claims representatives. Liberty Mutual's RightTrack program is an innovative feature that rewards safe driving behavior with discounts on premiums.

Technology Trends Impacting Bundle Insurance in 2025

In 2025, emerging technologies such as AI, blockchain, and IoT are set to revolutionize the insurance industry, including bundle insurance offerings for families. These advancements are reshaping the way insurance companies provide quotes and services, leading to more personalized and efficient solutions for customers.

AI-Powered Insurance Services

AI algorithms are being utilized by insurance companies to analyze vast amounts of data quickly and accurately. This enables them to assess risks more effectively and provide customized bundle insurance quotes based on individual family needs. With AI, insurers can offer more competitive pricing and streamline the underwriting process.

Blockchain for Secure Transactions

Blockchain technology is enhancing security and transparency in insurance transactions. By utilizing blockchain, insurance companies can create immutable records of policies, claims, and payments. This not only reduces the risk of fraud but also speeds up the claims process for families covered under bundle insurance policies.

IoT Integration for Risk Prevention

The integration of IoT devices, such as smart sensors and wearable technology, allows insurance providers to monitor and prevent risks proactively. For families, this means potential discounts on bundle insurance premiums for adopting smart home devices that can detect and prevent common perils like water leaks or fires.

Enhanced Customer Experience

Overall, these technology trends are expected to enhance the customer experience for families seeking bundle insurance coverage. By leveraging AI, blockchain, and IoT, insurance companies can offer more tailored and affordable solutions, leading to greater customer satisfaction and loyalty in 2025.

Final Thoughts

In conclusion, the landscape of insurance for families in 2025 is evolving rapidly, with bundle insurance becoming an increasingly popular choice. By staying informed on the top providers and technological advancements, families can make well-informed decisions to protect their loved ones and assets.

FAQ Corner

What is bundle insurance and why should families consider it?

Bundle insurance combines multiple policies into a single package, offering cost savings and convenience for families managing various insurance needs.

What factors should families consider when evaluating insurance quotes?

Key factors include coverage, deductibles, premiums, add-ons, and customization options based on the family's unique needs and circumstances.

Which top insurance providers are recommended for families in 2025?

The top insurance providers in 2025 for families include [List the providers here], offering competitive coverage, pricing, and innovative services tailored to family needs.